Santacruz Silver Produces 3.2 Million Silver Equivalent Ounces in 2021

Vancouver, B.C. – Santacruz Silver Mining Ltd. (TSXV:SCZ) (“the Company” or “Santacruz”) reports its operating results for the fourth quarter (“Q4”) of 2021 and for the year ended December 31, 2021 and provides an operations update.

2021 Production Highlights (compared to 2020):

- Silver 1,289,172 oz (+14%); Zinc 12,518 tonnes (+15%); Lead 3,747 tonnes (-2%); Copper 1,820 tonnes (+18%)

- Despite material production increases in all metals except lead, silver equivalent (Ag eq) consolidated annual production decreased 10% to 3,220,974 Ag eq ounces (2020 - 3,590,451 Ag eq ounces) due primarily to a higher silver price being used in the Ag eq calculation for 2021 (Ag $25.00/oz) compared to 2020 (Ag $17.85/oz)

- Zimapan Mine silver, zinc, lead and copper production all exceeded prior results on a quarterly basis (Q4 2021 vs Q4 2020 in addition to Q4 2021 vs Q3 2021) as well as an annual basis (fiscal year 2021 vs fiscal year 2020)

“Operationally the Zimapan Mine had an excellent year as we were able to increase throughput by 17% compared to 2020. This production increase compensated for production losses realized by placing the Rosario Mine into care and maintenance during the year.” commented Carlos Silva, CEO. “This was achieved despite country wide closures due to COVID-19. Additionally, we anticipate concluding the acquisition of the Glencore Bolivian silver assets shortly, which will have a significant positive impact on our 2022 production levels.”

Mr. Silva continued, “Our goal in 2022 is to continue optimizations and further improve production rates, particularly as new underground areas offer expansion potential at the Zimapan Mine. Of note, during Q4 2021 the Company completed development works on a new mineralized zone, the Lomo del Toro Zone, which will contribute to higher grade mineralized material mill feed.”

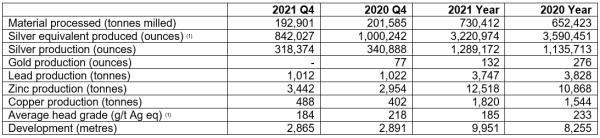

CONSOLIDATED PRODUCTION RESULTS

Select consolidated operating results for the three months and twelve months ended December 31, 2021 and the three months and twelve months ended December 31, 2020 is presented below:

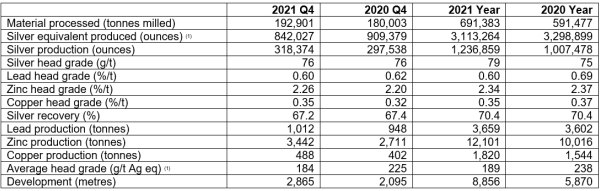

ZIMAPAN MINE PRODUCTION RESULTS

Select operating results for the Zimapan Mine for the three months and twelve months ended December 31, 2021 and the three months and twelve months ended December 31, 2020 is presented below:

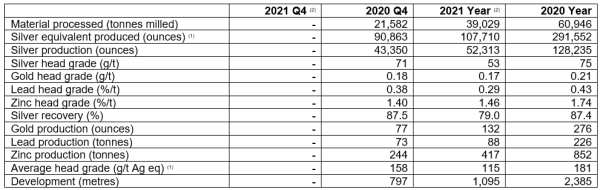

ROSARIO MINE PRODUCTION RESULTS

Select operating results for the Rosario Project for the three months and twelve months ended December 31, 2021 and the three months and twelve months ended December 31, 2020 is presented below:

(1) In the above tables, Ag eq has been calculated as follows:

2021 Ag eq was calculated using metal prices of: Ag $25.00/oz, Au $1,925/oz, Pb $0.85/lb, Zn $1.05/lb and Cu $3.00/lb.

2020 Ag eq was calculated using metal prices of: Ag $17.85/oz, Au $1,480/oz, Pb $0.92/lb, Zn $1.09/lb and Cu $2.80/lb.

(2) Operations at the Rosario Project were suspended in Q3 2021.

Zimapan Mine

Production throughput has increased 17% from 2020. At the Monte Mine, a new manto style mineralized body was discovered in December (the “Gachupines Zone”). An aggressive exploration program has been put in place, and an access ramp is being developed with the objective of reaching the Gachupines Zone by the end of Q2 2022. Management anticipates that the Gachupines Zone, in addition to the Lomo del Toro Zone will increase the silver head grades and tonnage having a positive impact on operating cash flows.

Rosario Project

As advised in the Company’s news release dated October 5, 2021, operations at the Rosario Project have been suspended. The Company will continue with permitting activities and remediation programs so that the Rosario Project is positioned for a timely restart should project economics improve.

About Santacruz Silver Mining Ltd

The Company is engaged in the operation, acquisition, exploration and development of mineral properties in Latin America, with a primary focus on silver and zinc, but also including gold, lead and copper. The Company currently has one producing project, the Zimapan Mine. In addition, the Company holds two exploration properties in its mineral property portfolio, the La Pechuga Property and the Santa Gorgonia Prospect.

‘signed’

Arturo Préstamo Elizondo,

Executive Chairman

For further information please contact:

Mars Investor Relations

Telephone: (778) 999 4653

scz@marsinvestorrelations.com

Arturo Prestamo

Santacruz Silver Mining Ltd.

Email: info@santacruzsilver.com

Telephone: (604) 569-1609

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking information

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws, including statements relating to production at the Zimapan Mine and Rosario Project and the Company's plans to grow it. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions. In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including that the Company's financial condition and development plans do not change as a result of unforeseen events and that future metal prices and the demand and market outlook for metals will remain stable or improve. Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the risk that any of the assumptions referred to above prove not to be valid or reliable; market conditions and volatility and global economic conditions, including increased volatility and potentially negative capital raising conditions resulting from the continued COVID-19 pandemic and risks relating to the extent and duration of such pandemic and its impact on global markets; risk of delay and/or cessation in planned work or changes in the Company's financial condition and development plans; risks associated with the interpretation of data (including in respect of third party mineralized material) regarding the geology, grade and continuity of mineral deposits; the uncertainty of the geology, grade and continuity of mineral deposits and the risk of unexpected variations in mineral resources, grade and/or recovery rates; risks related to gold, silver, base metal and other commodity price fluctuations; risks relating to environmental regulation and liability; the possibility that results will not be consistent with the Company's expectations, as well as the other risks and uncertainties applicable to mineral exploration and development activities and to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. There can be no assurance that any forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader should not place any undue reliance on forward-looking information or statements. The Company undertakes no obligation to update forward-looking information or statements, other than as required by applicable law.